Trade on the official crypto exchange of Börse Stuttgart

Trade Bitcoin, Ethereum and other Cryptocurrencies on Börse Stuttgart Digital Exchange from 0.20% per trade. Your trusted partner “made in Germany”. Open your account today and start trading.

Buy and sell cryptocurrencies - Transparent. Reliable. Fair.

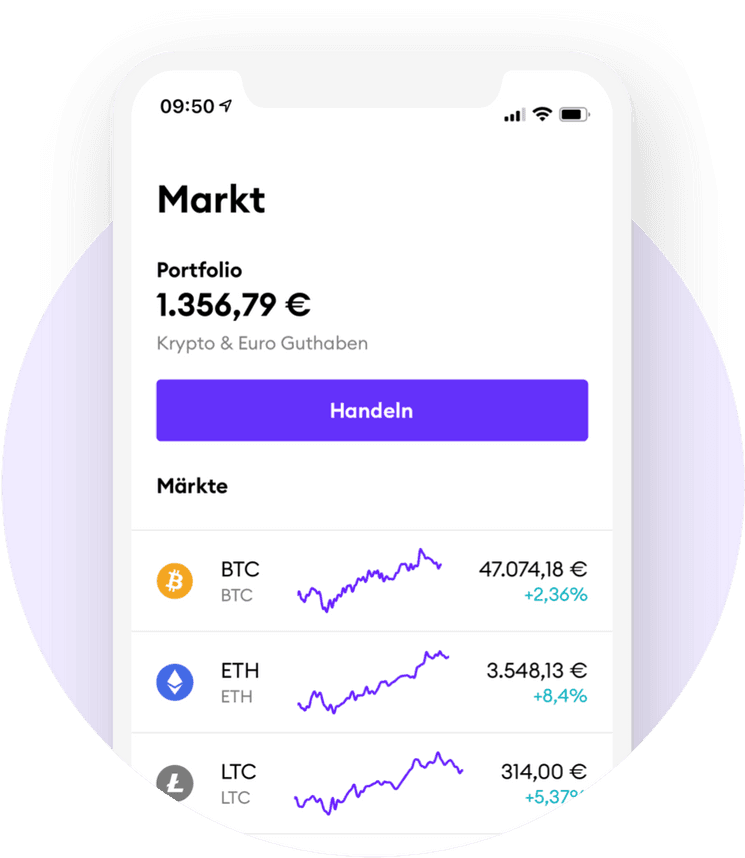

| # | name | price | change 24h | chart | trade |

|---|---|---|---|---|---|

1 | Bitcoin btc | ||||

2 | Ethereum eth | ||||

3 | Litecoin ltc | ||||

4 | XRP xrp | ||||

5 | Bitcoin Cash bch | ||||

6 | Uniswap uni | ||||

7 | Chainlink link | ||||

8 | Cardano ada | ||||

9 | Polkadot dot | ||||

10 | Solana sol |

Low Fees. Transparent Trading. Reliable Custody.

Low Fees

Take a close look! Trading venues differ from one another, especially in terms of costs. At BSDEX, you only pay transaction fees. No hidden costs. You can find more information about our transaction fees here.

Trust is good, but control is better

The multilateral trading system of BSDEX fulfils the regulatory requirements pursuant to Section 2 para. 12 KWG (German Banking Act). EUWAX AG, which is in charge of increasing liquidity, is also a regulated financial services provider.

Made in Germany

From legitimation to trading and custody service – all BSDEX partners are from Germany. And if there are any questions, our customer support is of course available for you.

Reliability & Transparency

BSDEX is benefiting from the many years of expertise of the Börse Stuttgart group: Transparency and liquidity protection are able to be carried over from securities trading to crypto trading.

Quick & easy account opening

1. Register

Easy: the registration on our website only takes a few minutes

2. Identify

Quickly via video ID: all you need is an Internet connection, a smartphone with a camera and an ID card

3. Trade

Directly: deposit the desired amount and place your first order

Powered by Börse Stuttgart. Made in Germany.

Drawing on the Börse Stuttgart Group's many years of expertise in traditional trading, we have created a trading venue for digital assets. The Börse Stuttgart Digital Exchange transfers transparency and liquidity assurance from securities to crypto trading.

Strong and trustworthy partners for custody, liquidity and banking

Custody

Both the cryptocurrencies purchased on the BSDEX and the cryptocurrencies placed in custody are kept in trust by Boerse Sutttgart Digital Custody GmbH, a company of the Börse Stuttgart group. For this purpose, a multi-level security concept was implemented at Boerse Sutttgart Digital Custody GmbH. The cryptocurrencies held in custody by Boerse Sutttgart Digital Custody GmbH are not lent to third parties.

Liquidity

EUWAX AG (together with other market participants) provides liquidity to ensure high trading quality. The company, which is part of the Börse Stuttgart group, acts as a designated liquidity provider and continuously provides bid and ask prices for a consistently high trading quality.

Banking

Euro balances are kept free of charge by the German Solaris SE and are subject to the statutory deposit protection fund up to 100,000 Euro per customer.

Open your account. Free of charge.

If you have any questions, please contact our Support-Team via E-Mail. We're looking forward to your feedback!